-

Becoming a professional: How do I take the first steps?

Before you visit the Chamber of Commerce, there are a few things you should consider:-

Choosing the Legal Structure: You need to decide on the legal form you’ll adopt for your business. Will you become a sole proprietor (Zzp’er), operate as a sole proprietorship, establish a foundation, or opt for a partnership, among others? Visit https://www.kvk.nl/en/registration/new-business/ for more information.

Choosing the Legal Structure: You need to decide on the legal form you’ll adopt for your business. Will you become a sole proprietor (Zzp’er), operate as a sole proprietorship, establish a foundation, or opt for a partnership, among others? Visit https://www.kvk.nl/en/registration/new-business/ for more information.

-

Registration Process: Think about what kind of entrepreneurial activities you plan to undertake. Are you a designer, artist, or teacher? Are you taking on projects as a welder (especially if you’re a certified welder, there’s demand for your services!)? Are you offering workshops or tutoring? Are you working as a web designer, desktop publisher, telemarketer, or something else entirely? All of these supplementary activities can influence how you register with the Chamber of Commerce, and they are coded by the Chamber with a Standard Business Format (SBI) code ( NL ENG). This is relevant because different jobs may have different VAT rates and various obligations, such as business liability, proof of good behavior, insurance, etc. All of these are part of your journey towards professionalism.

-

Choosing a Location: Consider where you want to establish your business. Will you use your home address or your studio as the registration address? Keep in mind that you can decide whether you want this information to be publicly available or not. The choice is yours and yours alone.

Choosing a Location: Consider where you want to establish your business. Will you use your home address or your studio as the registration address? Keep in mind that you can decide whether you want this information to be publicly available or not. The choice is yours and yours alone.

-

Opening a Business Account: Once you are registered as an entrepreneur, you can also open a business bank account. The advantage of this is that it allows you to keep your business expenses separate from your personal expenses. However, it’s worth noting that having a business bank account can be costly. You can consider to get a second bankaccount on your private name and use that for your business.

Opening a Business Account: Once you are registered as an entrepreneur, you can also open a business bank account. The advantage of this is that it allows you to keep your business expenses separate from your personal expenses. However, it’s worth noting that having a business bank account can be costly. You can consider to get a second bankaccount on your private name and use that for your business.

Summery:

Make your appointment here (Dutch), choose ‘Eenmanszaak’ or here (English), choose ‘Sole Proprietorship’

General site KvK: https://www.kvk.nl or https://www.kvk.nl/english/

tips for choosing the right SBI code: NLand more ENG

General Foreign Office guide: Business Gov

Tax office info for Germany – The Netherlands in Dutch In German -

-

-

Start page Belastingdienst English individuals

https://www.belastingdienst.nl/wps/wcm/connect/en/individuals/individuals

Start page Belastingdienst English a self-employed or as a small business

https://www.belastingdienst.nl/wps/wcm/connect/bldcontenten/belastingdienst/business/business

For Foreign students the Hogeschool Rotterdam has a special desk here

There is general info also to be found here: https://www.studyinholland.nl/

or

https://www.studyinnl.org/plan-your-stay/• Working while studying info

-

The regulations governing the employment of European Union (EU) residents operating as freelancers from the Netherlands in foreign jurisdictions are as follows:

When establishing the Netherlands as their primary place of business as a sole proprietor (ZZPer), individuals must be registered at a fixed address, namely a registered business address. Subsequently, they are required to conduct their value-added tax (VAT) and annual tax filings from the Netherlands. Even if a freelance assignment is carried out in one’s country of birth, while being registered as a business entity in the Netherlands, tax matters are still managed within the Dutch jurisdiction.

As citizens of an EU member state, individuals are entitled to work without a work permit, whether as employees or self-employed, in any EU country. Employers engaging self-employed individuals and freelancers from the European Economic Area (EEA), which includes EU countries, as well as Norway, Iceland, and Liechtenstein, are not required to obtain work permits for their engagement.

The conditions stipulate that within a 12-month period, the worker does not reside in the host country for more than 183 days. This period of 12 months may align with a calendar or fiscal year or constitute a continuous period of 12 months commencing from the first day of residence.

For non-EU residents working as freelancers from the Netherlands in foreign jurisdictions, regulations are as outlined below:

If the freelancer originates from a country outside the EEA or Switzerland, they must possess a residence permit for self-employment. Without this permit, the freelancer is not authorized to work in the Netherlands. However, they are exempt from the requirement of obtaining a work permit.

Under certain conditions, non-EU residents can operate as self-employed individuals, particularly if their activities contribute to the economy. Such individuals may apply for a residence permit titled ‘Arbeid als zelfstandige’ (Labour as Self-Employed).

Relevant and informative websites pertaining to these regulations and procedures include:

– https://www.government.nl

– https://business.gov.nl/

– https://www.studyinnl.org/

– https://www.werkenvoorinternationaleorganisaties.nl/

– https://business.gov.nl/regulation/work-permit-self-employed-professionals/

– https://www.government.nl/topics/foreign-citizens-working-in-the-netherlands

– https://ind.nl/en/residence-permits/work/residence-permit-self-employed-person -

VAT – Value Added Tax (In Dutch: BTW, de omzetbelasting)

Let’s keep it simple: Tax is added to all sales so the government gets money to get stuff done. You collect it for them when you sell work, but you do not want to pay it out of your pocket, so you ADD it to the amount you want to get. Just add it to the invoice. VAT needs to be added to the invoice. Usually 21%, but it can also be 9% or 0%.

Beroepkunstenaar has made a handy overview.

If you earn less then €20.000 a year you can opt for the ‘Kleine Ondernemers Regeling (KOR)’. Now you are VAT exempt.

TIP:

Put VAT received on a separate account so you don’t accidentally spend it. You will have to pay it forward to the Belastingdienst (IRS).

Read all about VAT at de Belastingdienst site.Everything BTW at the Belastingdienst (Dutch) & english version.

See also How to make / create an invoice

-

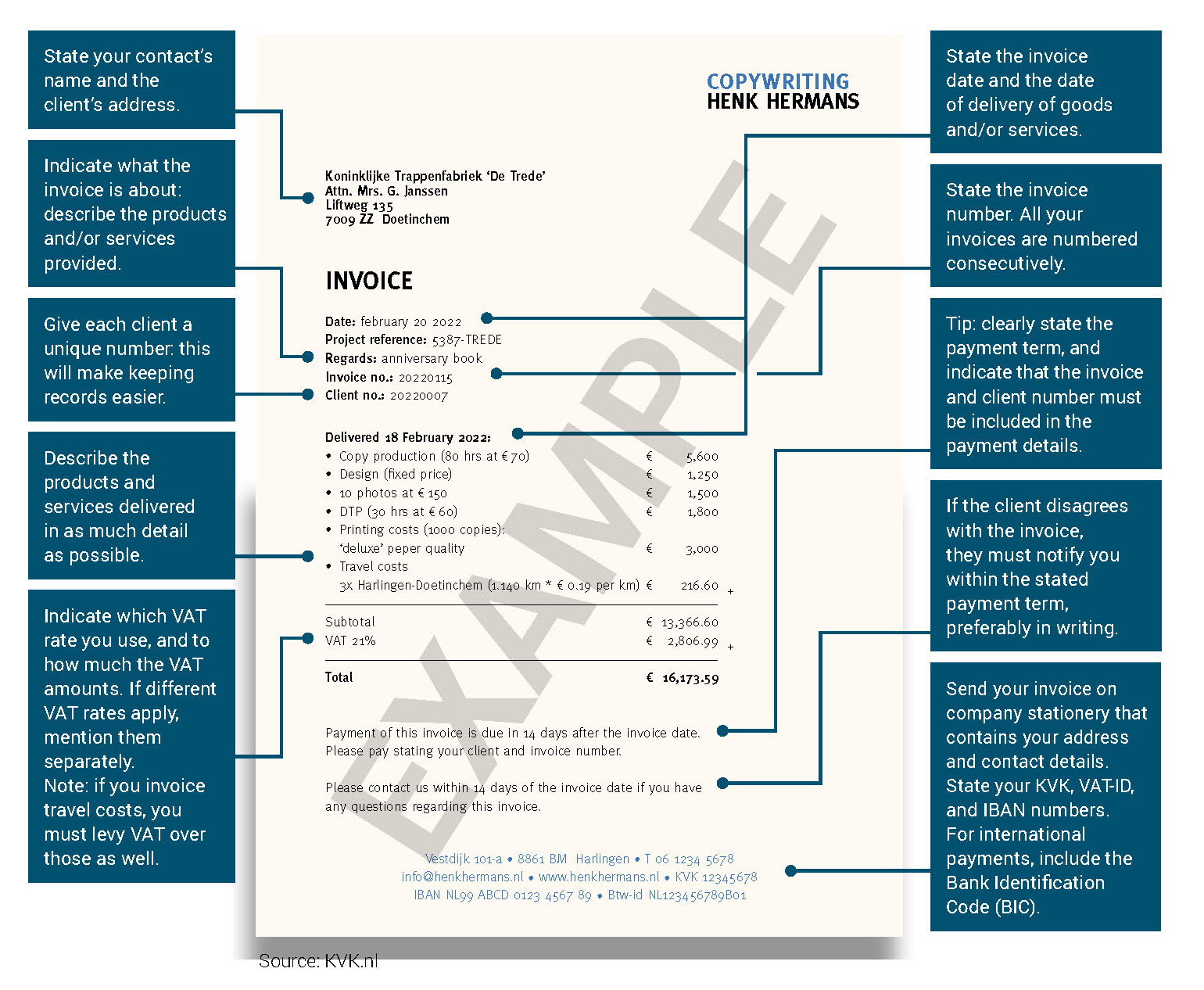

You did the work, you agreed on a price, so now you need to get paid. To get paid you send an invoice (factuur).

In essence you need two main items in there: what you delivered (item description) and how much you charge for it (price).

By law invoices need some more items on it. The basics are: date, your name and address, their name and address, invoice number, item description, price, amount/quantity, vat amount, vat number, chamber of commerce registration and conditions.

Here’s the entire list by de Belastingdienst(NL) & english versionThere dozens of ways to design your invoice. Here are 50 examples and here you find 50 more (your invoice is also a bit of branding).

Example using Dutch law and VAT percentages source: https://www.kvk.nl/english/starting-a-business-in-the-netherlands/checklist-getting-started/

-

Unlike an invoice, which usually includes VAT, a receipt does not mention VAT. A receipt is not an official document for invoicing VAT and serves only as proof of receiving money.

VAT indication: A receipt usually does not indicate VAT, unlike an invoice where VAT is charged. Proof of receipt of money: A receipt primarily serves as proof of receipt of money and is often used when no formal invoice is issued. Legal limitations and tax obligations: The use of a receipt may entail legal limitations, especially regarding tax obligations such as income tax and registration with the Chamber of Commerce. Turnover registration threshold: If a company’s turnover remains below the turnover registration threshold of € 1800 per calendar year, registration with the Chamber of Commerce is not required. Small Enterprises Scheme (KOR): Entrepreneurs who consistently remain below € 20,000 in turnover per year may qualify for the KOR scheme, potentially making them eligible for tax benefits or exemptions.

KOR regeling (Kleine Ondernemings Regeling). Small business RegulationOverall, the use of a receipt provides a simple way to document payments, but it is important to be aware of the tax and legal requirements applicable to the situation of an individual entrepreneur.

-

What is considered by the tax authorities as deductible costs?Here is a list with expenses that are accounted as business costs. You are able to deduct the VAT (btw) from the income as expenses for your 3 monthly VAT return or your annual return.Materials: paint, clay, paper, office materials but also professional literature

Fixed Charges: Webhosting, Studio, Office, storage, Subscriptions, insurance

Hardware: computer, phone, welding machine, harddisk, printer

Maintenance costs of computers, printers, etc., Software and tools

Practice transport, car, rental, bike, train tickets, flights, fuel and car, parking costs, Hotel, Rent a car/bicycle/scooter

Marketing, Advertising communications, promotional costs, website

Business support, Accountant, Engaging other companiesWith all these things: only when purchased solely for professional use.

So your car is on the business side of things and if you use it private you have to register those private kilometers.Check also this -

Broodfonds (English: “Bread fund”) is a Dutch collective that allows independent entrepreneurs to provide each other with temporary sick leave.

Those who wish to participate in a bread fund can join an existing group of like minded entrepreneurs, or start one themselves. The recommended minimum is 25 people, the maximum size is 50 people to avoid a degree of anonymity. A ‘broodfonds’ organises solidarity by personal connections and networking and its members are self-governing. (txt from WIKI)

New insurance for ZZP: https://zelfverzekerd.oogvoorimpuls.nl/

Also insurance for artists & designers

https://aovfondskunstencultuur.nl/

Insurance in The Netherlands for foreign students info

WA verzekering / Third-party liability insurance, or business liability insurance

This is not mandatory for self-employed persons, but it is strongly recommended. This insurance protects you against the financial consequences of damage that you cause to others as a self-employed person, both material damage and personal injury. Without this insurance, the costs of a claim for damages, which can increase considerably, can cause you as a self-employed person to have major financial problems.

Rechtsbijstandsverzekering Legal expenses insurance

This is for self-employed persons not a mandatory insurance, but it can be very useful. It offers legal assistance and coverage for conflicts that you may encounter as an entrepreneur, such as disputes with customers, suppliers, or the government. -

Art in general

Kunstenbond https://kunstenbond.nl Art in general

CNV

https://www.cnvvakmensen.nl/ Traditional union with Art departmentFNV KIEM https://www.fnv.nl/cao-sector/media-cultuur Traditional union with Art department

BBK

https://www.bbknet.nl/ professional association of visual artists.Schakel025

https://schakel025.in

Platform kennis over de zakelijke en organisatorische kant van werken in de kunst- en cultuursector.

De Creatieve Coalitie

https://www.decreatievecoalitie.nl/

Umbrella association of and for professionals working in the cultural and creative sector.Art

Kunsten92 https://www.kunsten92.nl/ interest group for the cultural and creative sector

Platform BK https://www.platformbk.nl/ Researches the role of art in society and takes action for a better art policy. Representing artists, curators, designers, critics and other cultural producers.

Beroepskunstenaar https://www.beroepkunstenaar.nl/ About the business side in arts & culture sector

Design

BNO

https://www.bno.nl/ National interest group for designersPhotography

DUPHO https://www.dupho.nl/ National interest group for Photography

AV & Animation

https://nbf.nl/ film- en televisiemakers

https://versfilmentv.nl/ Voor beginnende beeldmakers

https://www.producentenalliantie.nl/ Producers alliance

https://avproducenten.nl/ AV producers alliance

https://stop-nl.nl/ Producers in TV alliance

https://www.directorsguild.nl/

http://www.assistantdirectors.nl/

https://auteursbond.nl/sectie/netwerk-scenarioschrijvers/

https://www.cinematography.nl/

https://www.vfxprofessionals.nl/

Beroepsvereniging Componisten Multimedia https://www.bcmm.nl/

Art Education

VONKC

https://vonkc.nl/ Vereniging Onderwijs Kunst en CultuurIKCA

https://www.lkca.nl/ Landelijk Kennisinstituut Cultuureducatie en AmateurkunstMOCCA https://mocca.amsterdam/ Expertisecentrum Cultuuronderwijs

Cultuur Connectie https://www.cultuurconnectie.nl/ brancheorganisatie voor cultuureducatie oa.

Interior Architecture

BNI

https://bni.nl/ Professional Association of Dutch Interior Architects -

Platform BK Researches the role of art in society and takes action for a better art policy. Representing artists, curators, designers, critics and other cultural producers.

The Federation of Image Rights is a collaboration between Pictoright and the seven professional organizations that represent the interests of artists and designers.

https://federatiebeeldrechten.nl/

Schakel025 platform kennis over de zakelijke en organisatorische kant van werken in de kunst- en cultuursector.

https://schakel025.in

BBK Professional association of visual artists.

The Boekman Foundation is the independent knowledge center for art and cultural policy in the Netherlands.

The Federation of Culture brings together industry and employer associations in fields such as performing arts, museums, libraries, arts centers, stages, and orchestras. The Federation represents the common interests of these sectors.

Kunsten92 Advocacy organization for the cultural and creative sector

De Zaak Nu Industry association of subsidized presentation institutions for contemporary visual arts.

Dutch Culture Center for international cooperation

a-n The Artists Information Company

https://www.a-n.co.uk

TransArtists Taking the long view – a residency about residencies

Creatives Unite European platform providing information on working conditions, financing, and intellectual property.

All Arts Performing artistes, cultural institutions, sportsmen and sports organizations prefer to work with specialists who understand what they are doing and who work clever, smart and solid for their tax affairs. With involvement and knowledge about the tax rules and the business.

Platform that connects businesses with cultural organizations.

BK-informatie Trade journal for visual artists

Cultuurconnectie – Industry organization for cultural education, amateur arts, and adult education.

https://www.cultuurconnectie.nl

De Creatieve Coalitie The Creative Coalition is the umbrella organization for professionals working in the cultural and creative sector.

-

“Writing an application might seem like a monstrous task, but with a bit of analytical thinking, you’re already halfway there. It all starts with a solid plan — and then describing that plan as clearly and convincingly as possible. Lay out some handy reference points for yourself, the fund, and maybe even your audience, and YES — you’re almost done!”

This is the step by step guide

How do you find matching funds and subsidies?

- Look for suitable funds by analyzing your project

– What are your values and the values surrounding your project?

– Who is your audience?

– What is the goal and what are possible sub-goals of your project?

– What is the social, societal, cultural, economic context? Name them all!

– Who do you and/or your project connect with?

– What does it add?- Collect and create keywords from the above analysis.

- Search for funds and subsidies using these keywords.

For example, you can do that locally, such as: fund, colonialism, Rotterdam

or fund, sustainability, waste, re-use, Rotterdam

or: fund, art, dyslexia, critical, information, film

or dive into the commercially offered fund search engines

or read our website https://www.wdkabusinessstation.com/grants-subsidies

or use the fund book, het FondsenboekAll these are important parts of your application!

Before you begin

Most funds expect your project to have broad financial coverage, with a contribution from yourself or from the organization you may be working with, participant fees, donations from other funds, a subsidy from the municipality or income through entrance, sales or crowdfunding.

– Before you draw up and submit your grant application, it is useful to know how and when it will be assessed.

– The assessment is carried out by an advisory committee of the call, based on the call text to which you are responding/applying.

– Make sure that you read the criteria and specific objectives set out in the text from the fund carefully. Also study the conditions, the grounds for rejection and the tender procedure, to prevent later disappointment.

– For that deliver a good matching story, a correct and realistic plan and budget.

– Check de deadlines en vergaderdata van de fondsen voor je planningTry to understand that they are willing to give you money for your project if you have a match with their goals and objectives.

Immerse yourself in the possibilities

Check de deadlines!

Describe the values of you and your project. You can use Strategic Narrative and Telling Your Story from Making a Living to create this.Project Plan

The project plan is the cornerstone of your application.

You can use our sheets to work on this (Create your Narrative + Strategic Narrative).

In the Project Plan you describe the form and content of your project as clearly as possible, in response to the challenge formulated in regulation.

Present your work in a compact description of 1 paragraph and explain it on a practical and substantive level.

Tips:

– Separate the main from the minor.

– Make a clear definition and the issue in question, in response to the challenge formulated in the call.

– Explain why your project is relevant to your development

– Place your proposal within current art/design practice

– Explain the relevance of your project.

– Explain who you are making the project for (target group, audience, public)

– Define and discribe your collaboration partners

– Try to avoid repetition of text fragments.

– Make sure you have an evaluation planCommunications Plan

Your application must (in most cases) include a communications plan or presentation plan.

– Where you are now and why and how do you communicate.

– What do you want to achieve and why?

– The primary and secondary audience you want to reach and what you know about that.

– Errand: The main information that you want to convey to your audience.

– How you will achieve your goal,

– What choices you make,

– What overarching concept you come up with for this.Resources

– The specific means of communication you will use.

PlanningA good planning allows you to provide insight into the steps you are going to take to carry out your project and how long they will take. It is necessary for you, the people you work with or will deal with, the application and the fund.

A fund always sets a time limit for a project (this is defined with a start and end date).Budget

The budget provides a realistic picture of the estimated costs and income that are related to the implementation of your project. The specification of costs and income must enable the Fund to assess your underlying calculations and estimates.

– Determine the costs

Estimate realistic costs. Create 3 scenarios for yourself: one for the subsidy in which you have enough money to do everything you want, an ideal and a ‘slimmed-down’ version for yourself that is based on the minimum amount for which you can still realize the plan.

– Determine the income

The cost estimate is offset by the coverage plan, or the income from, for example, entrance fees, other subsidies, donations, sponsorship, merchandising and co-production, co-finance (funds can then get an idea of how the possible contribution relates to the total budget).

– Determine the amount you are going to ask. Also find out how much a fund contributes in principle.

– Write an explanation of your budget.

You have to explain on what basis you base certain costs and, for example, for how many hours you hire someone and at what daily rate. Request quotes from suppliers and specialists. Ask around you what is realistic.Note: At many public funds they want you to adhere to the Fair Practice Code. Inform yourself about this! It is necessary.Most funds work with a net budget. This means that you do not include VAT in the budget!

—Use always the budget form suggested by the fund.—

Ultimately it is a lot of work

Unfortunately, there are no guarantees.

You learn by doing.

The first is a nightmare.

The next one too.

Nothing ventured, nothing gained.

The Business Station can help with:– Finding and writing a good plan

– Creating a realistic budgetAT WORK

-

Smaller funds:

Amarte

development & project grants to realize relatively small scale projects

Keep an Eye Foundation

Special fund for young creatives.

https://www.volkskracht.nl

Funds art projects mainly in RotterdamSome general funds interesting for Art & Design.

https://www.rotterdam.nl/kunst-en-cultuur

https://www.amsterdamsfondsvoordekunst.nl

https://www.ammodo.org stimuleert de ontwikkeling van kunst, architectuur en wetenschap.

https://vdef.nl

Private fund VDEF contributes to strengthening the cultural climate in the Netherlandshttps://www.cbkrotterdam.nl

Rotterdam based art fund. Connected to Tent.

https://artoffice.info/

Rotterdam Art community for and by artists. Funds, loans, links to studio’s and intrest events available.https://bankgiroloterijfonds.doen.nl

Supports pioneers who are committed to a green, social and creative societyhttps://kfhein.nl

Supports artists and designers from the province of Utrechthttps://www.lira.nl

For professional writers/journalists,researchershttps://www.clicknl.nl/subsidieregelingen/

Product innovations and research in the creative sector.https://www.fleurgroenendijkfoundation.nl

Projects in the field of architecture, public art or art in public space.https://www.mondriaanfonds.nl

Big Public state fund for the artshttps://www.creativeeuropedesk.nl

Advises on the grant schemes of the Creative Europe programmehttp://stimuleringsfonds.nl

Support young, up-and-coming designers and makers as well as established talents with their artistic and professional development.http://fondskwadraat.nl

Interest-free loans for artist, photographers and designershttp://fondspodiumkunsten.nl

National fund for professional music, (music) theatre, dance and festivals in the Netherlands.https://www.doen.nl

Supports pioneers who are committed to a green, social and creative societyhttp://www.blockbusterfonds.nl

Bundling of various funds to help make exceptional cultural projects possible.https://www.fonds21.nl

Support professional, high-quality projects that manage to reach a broad and/or new audience.https://www.cultuurfonds.nl

One of the bigest private funds supports projects in the field of visual arts, heritage, history & literature, music, theatre, dance & film, nature.https://www.vsbfonds.nl

Support projects for a social, inclusive and creative society. Also grants for students and artists active in this field.https://www.fonds1818.nl

The Hague region based. How do you make a society more social, more inclusive, more active and greener?PDF Funds:

Funds+AV+-+animation -

Setting up a shop in the Netherlands is easy with a registration at the KvK and a VAT number.

A pop-up store is a store that you open in a temporary place, such as an empty retail building, a squat or a regular market spot. Link

An online shop Find out what you need to do when starting an online shop. Learn from the experiences of other entrepreneurs who have started online webshops. link

-

Since 2017, there has been a code of conduct for everyone working and operating within the arts, culture, and creative industries in the Netherlands: the Fair Practice Code. Based on values such as solidarity, diversity, trust, and transparency, this code outlines agreements meant to create equal opportunities and fair payment across the cultural sector. But how is the sector actually doing and dealing with it?

The Fair Practice Code serves well as a policy tool. It is becoming more standard for artists to be paid.The guideline for artist fees is based on the legal minimum wage and is meant to be a starting point for negotiations. But in practice, that minimum has become the standard. Artists should feel empowered to negotiate and explore whether their work is worth more than the minimum rate. But: the Fair Practice Code doesn’t provide enforceable tools.-

Don’t be afraid to negotiate

Prepare well: know your minimum fee (e.g., artist honorarium) and the amount you want to earn. Start slightly above that in your initial proposal. Think about your response if someone says your rate is too high. Take the initiative in negotiations—you set the tone. -

Learn how to negotiate

You learn best by practicing. Ask a colleague to rehearse with you in a role-play where they act as a difficult client. -

Connect with other artists

Join a network, studio group, or circle of peers. Share tips and support one another—not just artistically, but also in managing your career. -

Keep developing your business skills

Consider joining a mentorship program or training course that focuses on entrepreneurship. -

Work with professionals

A good accountant, fundraiser, or coach can be a valuable investment that pays off in the long run. -

Expand your network

Attend openings, talks, and events. Apply for residencies. Get involved in boards, juries, or advisory committees. -

Create a realistic budget

Include the time you spend writing funding applications as part of your in-kind contribution. -

Communicate the value of your work

Especially for commissioned or applied art, explain the investment required—such as your time, process, and research. This helps clients understand your fee and builds mutual respect.

This is a summary of the Fair Practice Code meeting the Business Station did with Art Office in collaboration with BBK

-